Bicycle Road Tax Uk . They also don't pay ved as this is based on vehicle. However the police do have. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. A recent vehicle tax reminder or ‘last chance’ warning letter from. Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. If you’ve applied for vehicle tax or a sorn, it can. The roads and finance act of 1920. Tax your car, motorcycle or other vehicle using a reference number from:

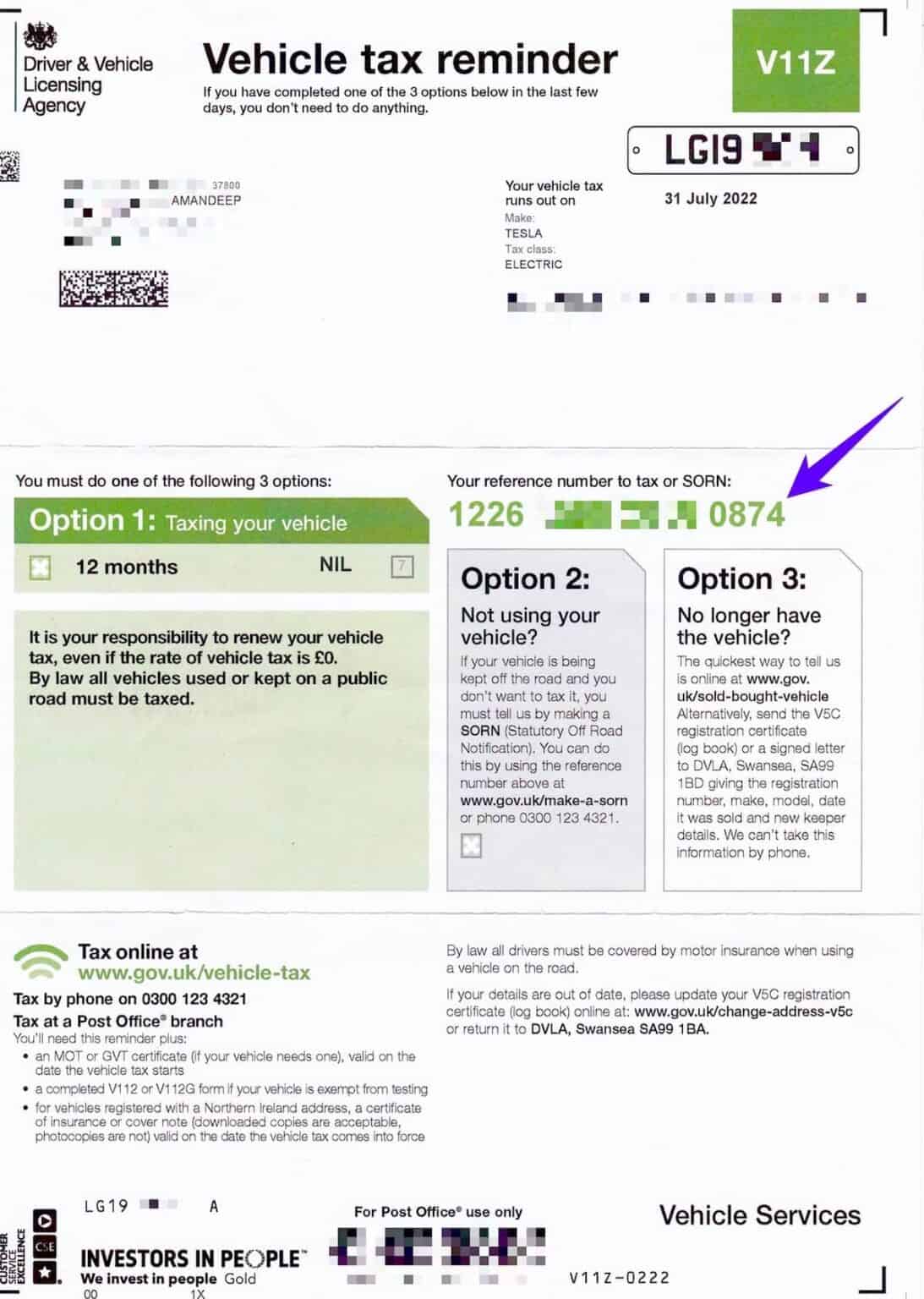

from teslastir.com

Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. They also don't pay ved as this is based on vehicle. A recent vehicle tax reminder or ‘last chance’ warning letter from. However the police do have. If you’ve applied for vehicle tax or a sorn, it can. Tax your car, motorcycle or other vehicle using a reference number from: The roads and finance act of 1920. Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of.

Tesla Road Tax UK 2024 (Explained) How to Tax your EV?

Bicycle Road Tax Uk Tax your car, motorcycle or other vehicle using a reference number from: Tax your car, motorcycle or other vehicle using a reference number from: Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. The roads and finance act of 1920. A recent vehicle tax reminder or ‘last chance’ warning letter from. They also don't pay ved as this is based on vehicle. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. However the police do have. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. If you’ve applied for vehicle tax or a sorn, it can.

From surreycyclingclub.co.uk

Understanding Two Abreast Cycling Legality, Safety, and Myths Bicycle Road Tax Uk Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. A recent vehicle tax reminder or ‘last chance’ warning letter from. However the police do have. Tax your car, motorcycle or other vehicle using a reference number from: If you’ve applied for vehicle tax or a sorn, it. Bicycle Road Tax Uk.

From www.pinterest.com

No Cycling Traffic Rules Ahead Sign Bicycle Road Tax Uk Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence.. Bicycle Road Tax Uk.

From www.youtube.com

vehicle road tax online payment How to Pay Vehicle Road Tax Online Bicycle Road Tax Uk A recent vehicle tax reminder or ‘last chance’ warning letter from. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. However the police. Bicycle Road Tax Uk.

From www.topgear.com

New road tax rules explained here's what you'll pay Top Gear Bicycle Road Tax Uk Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. A recent vehicle tax reminder or ‘last chance’ warning letter from. If you’ve applied for vehicle tax or a sorn, it can. They also don't pay ved as this is based on vehicle. However the police do have.. Bicycle Road Tax Uk.

From www.wapcar.my

Road tax paid to JPJ don’t go to road maintenance, so what are we Bicycle Road Tax Uk Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. Tax your car, motorcycle or other vehicle using a reference number from: They also don't pay ved as this is based on vehicle. The roads and finance act of 1920. If you’ve applied for vehicle tax. Bicycle Road Tax Uk.

From www.youtube.com

Myths & facts road tax Cycling Scotland YouTube Bicycle Road Tax Uk If you’ve applied for vehicle tax or a sorn, it can. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Tax your car, motorcycle or other vehicle using a reference number from: Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of.. Bicycle Road Tax Uk.

From www.recycleandbicycle.co.uk

Foska Road Tax Cycling Jersey 42" Chest ReCycle & BiCycle Bicycle Road Tax Uk Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. A recent vehicle tax reminder or ‘last chance’ warning letter from. The roads and finance act of 1920. They also don't pay ved as. Bicycle Road Tax Uk.

From mavink.com

Cycle Road Signs Bicycle Road Tax Uk Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. However the police do have. A recent vehicle tax reminder or ‘last chance’ warning letter from. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on. Bicycle Road Tax Uk.

From teslastir.com

Tesla Road Tax UK 2024 (Explained) How to Tax your EV? Bicycle Road Tax Uk Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. Just like drivers, cyclists don't pay road tax because it was abolished in 1936.. Bicycle Road Tax Uk.

From www.change.org

Petition · Road tax and a licence for UK cyclists United Kingdom Bicycle Road Tax Uk The roads and finance act of 1920. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. They also don't pay ved as this is based on vehicle. Tax your car, motorcycle or other. Bicycle Road Tax Uk.

From www.etsy.com

Edit and Print Your Own Replica Road Tax Disc 1963 1977 for Etsy UK Bicycle Road Tax Uk However the police do have. Tax your car, motorcycle or other vehicle using a reference number from: They also don't pay ved as this is based on vehicle. Vehicle excise duty (ved), formally known as road tax, must be displayed on vehicles registered in the united kingdom and is an annual fee. The roads and finance act of 1920. Not. Bicycle Road Tax Uk.

From bikeportland.org

Oregon’s bike tax revenue is far below expectations, while admin Bicycle Road Tax Uk They also don't pay ved as this is based on vehicle. If you’ve applied for vehicle tax or a sorn, it can. Tax your car, motorcycle or other vehicle using a reference number from: Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. However the police. Bicycle Road Tax Uk.

From www.pinterest.ca

30 off Ebikes?! EBIKE ACT tax credit explained Bicycle Road Tax Uk Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Tax your car, motorcycle or other vehicle using a reference number from: They also don't pay ved as this is based on vehicle. A. Bicycle Road Tax Uk.

From teslastir.com

Tesla Road Tax UK 2024 (Explained) How to Tax your EV? Bicycle Road Tax Uk If you’ve applied for vehicle tax or a sorn, it can. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. Tax your car, motorcycle or other vehicle using a reference number from:. Bicycle Road Tax Uk.

From www.alamy.com

uk road tax disc Stock Photo Alamy Bicycle Road Tax Uk Tax your car, motorcycle or other vehicle using a reference number from: The roads and finance act of 1920. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. Not having ved is. Bicycle Road Tax Uk.

From www.alamy.com

UK road tax disc Stock Photo Alamy Bicycle Road Tax Uk They also don't pay ved as this is based on vehicle. If you’ve applied for vehicle tax or a sorn, it can. Tax your car, motorcycle or other vehicle using a reference number from: Rates of vehicle tax for cars, motorcycles, light goods vehicles and private light goods vehicles v149 the following tables give the rates of. Vehicle excise duty. Bicycle Road Tax Uk.

From www.pinterest.com

10 Tax Refund Cycling Splurges Tax refund, Splurge, Bike parts Bicycle Road Tax Uk They also don't pay ved as this is based on vehicle. If you’ve applied for vehicle tax or a sorn, it can. The roads and finance act of 1920. Just like drivers, cyclists don't pay road tax because it was abolished in 1936. However the police do have. Vehicle excise duty (ved), formally known as road tax, must be displayed. Bicycle Road Tax Uk.

From www.trustedreviews.com

Car Tax Band Changes 2017 What the VED changes mean for UK drivers Bicycle Road Tax Uk A recent vehicle tax reminder or ‘last chance’ warning letter from. If you’ve applied for vehicle tax or a sorn, it can. The roads and finance act of 1920. Not having ved is a revenue offence rather than a motoring offence, resulting in a fine but not points on your licence. However the police do have. Rates of vehicle tax. Bicycle Road Tax Uk.